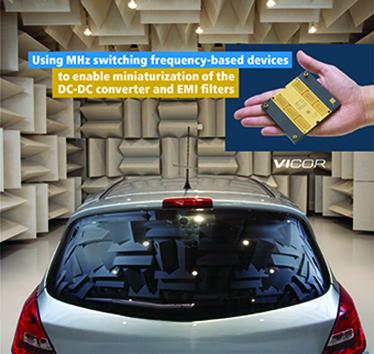

MHz switching frequency-based devices enable miniaturization of the DC-DC converter and EMI filters

Achieving EMI conducted emission compliance for automobiles with a single stage filter. By Nicola Rosano, Sr. Strategic FA/System Engineer at Vicor

More details...

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

Global semiconductor revenues fell by 2 percent in 2015. Sequential quarterly growth was weak throughout every quarter of 2015, especially in the first quarter when the market declined 8.9 percent over the previous quarter - the deepest sequential quarterly decline since the semiconductor market collapsed in the fourth quarter of 2008 and first quarter of 2009. Global revenue in 2015 totaled $347.3 billion, down from $354.3 billion in 2014, according to market researcher IHS www.ihs.com). The market drop follows solid growth of 8.3 percent in 2014 and 6.4 percent in 2013. “Weak results last year signal the beginning of what is expected to be a three-year period of declining to stagnant growth for semiconductor revenues,” said Dale Ford, chief analyst at IHS Technology. “Anemic end-market demand in the major segments of wireless communications, data processing and consumer electronics will hobble semiconductor growth during this time.”

Overall semiconductor revenue growth will limp along at roughly 2.1 percent growth compound annual growth rate (CAGR) between 2015 and 2020. Current technology, economic, market and product trends suggest that sometime between 2020 and 2022 new products will come to market that will enable a significant level of growth in semiconductor revenues.

“Of course the big story for the semiconductor industry was the record level of merger-and-acquisition activity last year,” Ford said. “Top players pursued bold, strategic maneuvers to enhance their market position and improve overall revenue growth and profitability”, Ford stated. Intel retained its number one ranking in 2015, after completing its acquisition of Altera, which allowed the company to offset declining processor revenues and achieve 2.9 percent overall growth in 2015. Qualcomm slipped to number 4 in the rankings as its revenues fell by 14.5 percent, because the company’s 2015 acquisition of CSR was not enough to counter declining revenues in the wireless markets. The final major deal among the top 10 in 2015 was NXP’s acquisition of Freescale, which boosted it from number 15 in the 2014 rankings to number 7 in 2015. Among the top 20, Infineon’s acquisition of International Rectifier enabled it to jump to number 12 in 2015. Announced deals that are expected to close in the first half of 2016 will continue to reshape the leader board. Avago Technologies continues its aggressive acquisition activity with its purchase of Broadcom. Broadcom is already ranked at number 9 in 2015. The combined revenues of the two companies would place them at number 5 overall. ON Semiconductor’s acquisition of Fairchild Semiconductor should boost it up two notches in the rankings.

Only ten semiconductor market sub-segments worth more than $1 billion in annual revenue grew more than 5 percent year over year in 2015. Wireless communications logic application-specific integrated circuits (ASICs) and analog ASICs both grew 30 percent, while radio-frequency (RF) small signal transistors, wired communications logic ASICs and wireless communications application-specific standard products (ASSPs) grew between 10 percent and 20 percent.

But power discretes will see healthy growth of $12.4 billion in 2015 up to $14.6 billion in 2019, with MOSFETs keeping the highest market share of nearly 50 percent and IGBTs around 8.5 percent. The market for discrete power modules is predicted to grow in this time frame from $4.6 billion up to $6.3 billion with standard IGBT modules covering nearly 50 percent, IPMs 30 percent, and MOSFET modules arounf 5 percent.AS

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media