Features

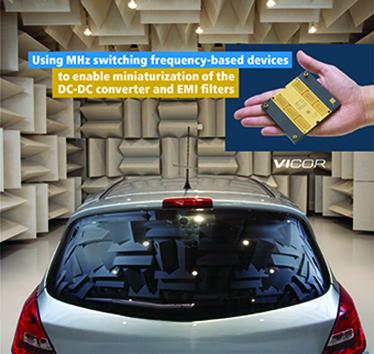

MHz switching frequency-based devices enable miniaturization of the DC-DC converter and EMI filters

Achieving EMI conducted emission compliance for automobiles with a single stage filter. By Nicola Rosano, Sr. Strategic FA/System Engineer at Vicor

More details...

AC/DC power factor correction module offers up to 1,512W

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

Power Electronics Europe News

Wide bandgap technologies reshape industry

WBG technologies offer higher frequency switching, higher power density, higher junction temperature and higher voltage capabilities (above 15kV). To now, the incumbent packaging solution does not fit their specifications. “Some companies offer a new enhanced package strategy addressing demand for WBG specifications. At mid-term, these new modules could target a $200million market in 2016, exceeding $1billion by 2020 or beyond”, comments Jérôme Azemar, analyst at Yole Développement. He says the WBG industry, especially SiC, is reshaping from a discrete

device business and evolving into a power module business. This was initiated by Powerex, MicroSemi, Vincotech or GeneSiC with hybrid Si/SiC products and now other players such as Mitsubishi, GPE and Rohm have full SiC modules.

PV inverters are the biggest consumer of SiC devices together with PFCs. The SiC device (bare-dies or packaged discretes) market reached about $75 million in 2012.

There are now more than 50 companies worldwide which have established a dedicated SiC or GaN device manufacturing capability with related commercial and promotion activities. Virtually, all other existing silicon-based power device makers are also more or less active in the SiC or GaN market but at different stages. All together, SiC and GaN devices and modules market is expected to top $1.4 billion by 2020, Yole forecasts.

A WBG semiconductor-based inverter, which switches electricity from direct current to alternating current, could be four times more powerful, half the cost and one-fourth the size and weight of a traditional inverter, says IDTech.

Following adoption, which is happening today, in PV power generation - solar power will replace power stations - followed by more general power grid applications. Next is the plug-in EV industry. WBGs may reduce size of a vehicle cooling system by about 60 % and cut the size of a fast DC charging station (eg 60kW) to the size of a kitchen microwave, says IDTechEx.

GaN-on-Si

Incumbent silicon based technology is reaching its limit and it is difficult to meet higher requirements. GaN based power electronics have the potential to significantly improve efficiency at both high power and frequencies while reducing device complexity and weight and is emerging as a substitution to the silicon-based technology. Today, Power GaN remains at its early stage and presents only a tiny part of power electronics market.

“We are quite optimistic about the adoption of GaN-on-Si technology for Power GaN devices.

Contrary to the LED industry, where GaN-on-Sapphire technology is mainstream and presents a challenging target, GaN-on-Si will dominate the GaN-based power electronics market because of its lower cost and CMOS compatibility”, says Yole Développement’s analyst Eric Virey. The overall cost of GaN devices are expected to be lower than Si devices three years from now, according to some manufacturers.

“In our nominal case, GaN based devices could reach more than 7% of the overall power device market by 2020. GaN-on-Si wafers will capture more than 1.5% of the overall power substrate volume, representing more than 50% of the overall GaN-on-Si wafer volume, subjecting to the hypothesis that the 600V devices would take off in 2014 to 2015,” says Virey.

To adopt the GaN-on-Si technology, device makers have the choice between buying epi-wafers or templates on the open market, or buying MOCVD reactors and making epi-wafer themselves. Today, there is a limited number of players selling either epi-wafers or templates or both on the open market.

GaN vendor strategies

GaN power technology, in addition to SiC, remains the only viable technology available for a wide scale commercialization of high-voltage power devices for the next-generation power systems. While long-term commercialisation prospects for GaN power devices are high, near-term commercialisation prospects are constrained by a range of technology, manufacturing, and industry infrastructure issues. Vendors use a diverse range of strategies to mitigate these constraints, which could be segmented into three major categories, including volume manufacturing of reliable GaN power devices, cost reduction, and application enablement, according to a new report from market researcher VentureQ.

Vendors engaged in commercialisation of GaN power devices include a broad range of vendor types featuring diverse business attributes. In order to address and analyse this diversity, market researcher Venture-Q segmented vendors by type and common business attributes into four major categories, including new ventures, market leaders in power discretes and modules, vertically integrated semiconductor vendors, and mainstream vendors of discretes and ICs.

A comparison of the November 2013 vendors’ GaN power devices commercialisation status with that from December 2012 reveals that little has changed. This indicates that all vendors face similar issues in dealing with the prior discussed technology and industry infrastructure constraints. The figure also indicates that only a handful of vendors are potentially capable to deliver commercially viable products in the near future. Since March 2010, Efficient Power Conversion (EPC) remains the only vendor offering GaN power devices (less than 200 V) on the open merchant market. The recently announced Fujitsu-Transphorm engagement is, according to VentureQ, the only significant commercialisation relevant development.

View PDF

View PDF

| Home / News / Features / Events / Media Data / Issue Archive / Magazine Subscription / Contact Us

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media