Features

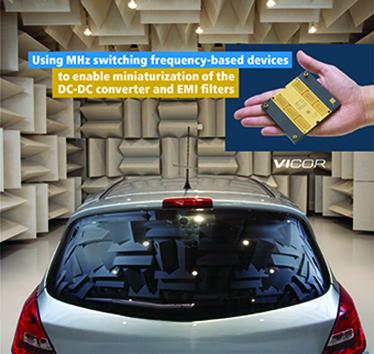

MHz switching frequency-based devices enable miniaturization of the DC-DC converter and EMI filters

Achieving EMI conducted emission compliance for automobiles with a single stage filter. By Nicola Rosano, Sr. Strategic FA/System Engineer at Vicor

More details...

AC/DC power factor correction module offers up to 1,512W

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

Power Electronics Europe News

Solar industry's fortunes look set to rise

.jpg) Global capital spending by producers of PV modules, cells, ingots, wafers and polysilicon is expected to rise by 30% next year, to reach $3.0 billion. This will mark the first time that expenditure will have increased since 2011, when it grew 8%. This is welcome news, as it would bring to an end a two-year period when spending dropped by a staggering 72% in 2012, and by an anticipated 36% this year.

Global capital spending by producers of PV modules, cells, ingots, wafers and polysilicon is expected to rise by 30% next year, to reach $3.0 billion. This will mark the first time that expenditure will have increased since 2011, when it grew 8%. This is welcome news, as it would bring to an end a two-year period when spending dropped by a staggering 72% in 2012, and by an anticipated 36% this year. PV industry capital spending will plunge by $10.6 billion, falling to $2.3 billion in 2013, down from $12.9 billion in 2011. The reasons for the fall in spending is attributed to over-capacity and over-supply, which has lowered prices throughout the supply chain.

On a positive note, a sustained increase in capacity from emerging economies is set to spur the 2014 recovery. Current and potential trade conflicts concerning Chinese PV products could drive production to other locations, such as South America, Southeast Asia, Africa and the United States.

More important for power electronics - the global market for micro-inverters will expand by a factor of four from 2013 through 2017 as they are adopted in greater numbers outside the United States while new markets also rush to take advantage of the devices’ improved efficiency and features compared to conventional inverters. Microinverters can increase the energy harvest of a system compared to conventional string or central inverter devices, which convert power from multiple solar panels.

This year is forecast to be the first that microinverter shipments grow to more than 500MW. Enphase Energy remained the led supplier dominating the residential PV market in the United States, although new entrants are releasing products, including SMA and Power-One. This competition will result in microinverter prices dropping by 16% this year, with shipments set to grow and increase revenue to over $250million in 2013. And although prices will continue to fall in the coming years, IHS predicts that revenue will reach $700 million in 2017”, said PV market analyst, Cormac Gilligan.

A new trend for suppliers is to offer complete solar modules that integrate microinverters - AC modules. Some microinverter makers are partnering with module suppliers to produce these devices. SolarBridge Technologies and Enecsys Ltd. are some of the major suppliers now offering AC modules, and these companies have entered into a number of partnerships with module suppliers. “AC modules allow module suppliers to differentiate themselves from the competition while allowing microinverter makers to take advantage of the module suppliers’ sales channels,” Gilligan noted. “They also allow faster installation time as the microinverter is installed at the module factory rather than on-site, which can be a compelling reason for the adoption of microinverters”. IHS predicts that AC module shipments will more than quadruple in 2013 and continue growing to account for 32% of total global shipments in 2017.

View PDF

| Home / News / Features / Events / Media Data / Issue Archive / Magazine Subscription / Contact Us

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media