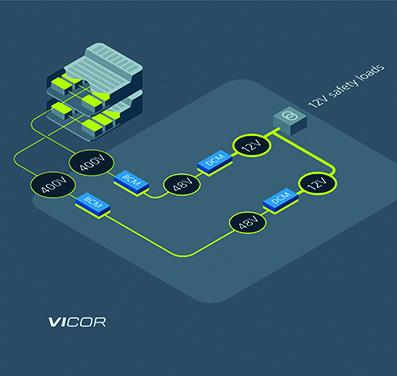

BEV advancements are driving sales, but vehicle safety and reliability will ensure long-term viability

Innovative power architectures using power modules provide power redundancy and improve overall safety and system performance By Patrick Kowalyk, Automotive FAE,Vicor

More details...

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

_ Source IDTechEx.png) Written by Luke Gear, principal technology analyst, the report looks into EV power electronics and the evolving semiconductor and package materials industry. It includes data on Si, SiC and GaN semiconductors, die-attach materials, wire bonding and thermal management. It also includes granular forecasts detailing unit sales, GW and US$ demand for inverters, onboard chargers (OBC) and DC/DC converters segmented by voltage (600V, 1200V) and semiconductor type (Si, SiC, GaN).

Written by Luke Gear, principal technology analyst, the report looks into EV power electronics and the evolving semiconductor and package materials industry. It includes data on Si, SiC and GaN semiconductors, die-attach materials, wire bonding and thermal management. It also includes granular forecasts detailing unit sales, GW and US$ demand for inverters, onboard chargers (OBC) and DC/DC converters segmented by voltage (600V, 1200V) and semiconductor type (Si, SiC, GaN).

SiC improves powertrain efficiency (EV range), operates at higher voltages for faster charging, and creates new materials opportunities, such as Ag or Cu sintering, as power densities and operational temperatures increase. SiC MOSFETs will feature in EV production in the next 10 years, says the report.

The IDTechEx report "" provides a deep-dive into EV power electronics with technology insights into the evolving semiconductor and package materials, including Si, SiC and GaN semiconductors, die-attach materials, wire bonding, thermal management, and more. IDTechEx presents

Infineon and ST Microelectronics both supply automotive power semiconductors, and both expanded major OEM partnerships recently.

Infineon has a deal to supply Stellantis' Tier 1 partners from 2025, potentially worth over one billion euros. Infineon also has a ten-year supply deal with VW, supplies into Hyundai's 800V E-GMP platform, and has a historic relationship with BMW for the original i3, as well as Renault.

STMicroelectronics has a major supply relationship with Tesla which commands around 14% market share of all BEV PHEV cars sold globally in 2022 according to the "Electric Cars 2023-2043" report from IDTechEx. the company has recently developed ACEPACK SiC modules as drop-in modules, which will help expand its customer base. It is also expanding production capacity in Italy and Hyundai has already chosen to use the modules in upcoming E-GMP models.

SiC adoption is gathering pace as other players release products, such as onsemi's EliteSiC SiC MOSFETs. It will supply VW and Hyundai. Tier 1 Borgwarner announced it would invest US$500 million in Wolfspeed, with Wolfspeed supplying SiC semiconductors to future Mercedes-Benz models and JLR's next generation of electric cars from 2024.

It is not all fast-paced acceleration, however. Tesla announced it was aiming for a 75% reduction in SiC utilisation for the cyber truck and future model releases. IDTechEx expects all Tesla's vehicles will continue to use SiC MOSFETs in most of their power electronics, however.

It was Tesla's 2018 Model 3 whic introduced SiC MOSFETs to the automotive sector at scale. The inverter design currently in use across Tesla's line-up is similar to this original inverter. IDTechEx expects that the announced reduction is being driven by smaller and more advanced SiC chips reaching commercialisation at a time when five years of real-world experience and understanding of SiC chip thermal management comes to fruitiion. It is also likely that Tesla's initial SiC inverter design was optimised for redundancy - extra chips - with the design now being optimised for cost and efficiency.

IDTechEx predicts a 27% CAGR for the period 2023 to 2033 for 600V to 1200V SiC MOSFETs in inverters, allowing the technology to capture more than half the market.

View PDF

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media