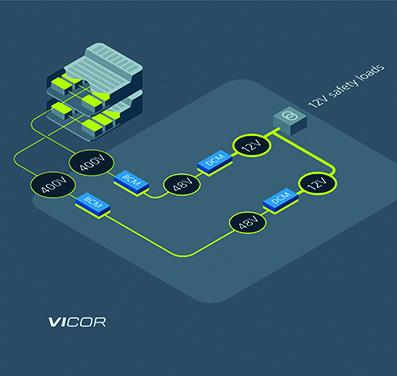

BEV advancements are driving sales, but vehicle safety and reliability will ensure long-term viability

Innovative power architectures using power modules provide power redundancy and improve overall safety and system performance By Patrick Kowalyk, Automotive FAE,Vicor

More details...

A full brick package developed by TDK-Lambda, the PF1500B-360, is for high voltage distributed power architectures

More details...

In Status of the Power Converter report, the analyst group predicts that the market value for power converters will reach US$146.1 billion by 2028, with an 8.7% CAGR between 2022 and 2028.

In Status of the Power Converter report, the analyst group predicts that the market value for power converters will reach US$146.1 billion by 2028, with an 8.7% CAGR between 2022 and 2028.

In 2022, the industrial motor segment represented the largest power converter market but the xEV power converter segment is growing substantially and is expected to become the third largest market by 2028.

Driven by the worldwide transition to renewable energy sources, such as solar PV and wind power, there is a growing need for power converters that can convert energy from these sources efficiently and easier their integration with the electricity grid.

China dominates in most end markets, particularly in converter suppliers and the ultimate target is increasing power density.

Hassan Cheaito, PhD.Technology & Market Analyst at Yole Intelligence, commented: “Power converters for battery energy storage systems will feature the fastest growth in the coming five years, with a 2022-2028 CAGR of 30.3%”.

Dr. Milan Rosina, PhD. Principal Analyst for the power electronics and battery division, added: “Automotive OEMs are increasingly involved in converter manufacturing to save costs and are leveraging their vertical integration”.

Yole Intelligence’s report highlights China’s dominant position in most end markets analysed, particularly in converter supply for xEV, wind and PV converter markets. This increase is attributed to the large domestic market for end systems (wind turbines, electric vehicles and PV inverters), the competitive advantage in terms of cost compared to regions like the USA and Europe and the dominant position regarding the supply and the cost of raw materials.

This has spurred innovation and alternative business approaches from non-Chinese players.

There has also been consolidation of the supply chain for high power converters, with the supply chain more secured compared to the one dedicated to low power solutions.

The analyst company has identified two noteworthy trends observed in terms of vertical integration. The first is that automotive OEMs are increasingly involved in converter manufacturing, and OEMs and Tier1s are moving towards manufacturing power modules and, in some cases, even power device bare dies. This trend is more prevalent in the xEV segment, where power modules and traction inverters play a crucial role in achieving technological differentiation.

The second trend is a shift from focusing solely on system manufacturing and sales toward service-oriented businesses. This includes services like project consulting, operation, and maintenance. This trend is particularly noticeable in established markets with a significant number of existing installations, such as rail, wind, and PV. It is also present in relatively new segments like BESS (battery energy storage systems) and EV DC chargers.

View PDF

| Privacy Policy | Site Map | © Copyright DFA Media

| Web design by Immersive Media